Q. I have just been turned down for a rental property because the agent says that I can not afford it, surely this is for me to decide.

How do agents decide whether you can afford a property?

Mr B, Paganhill

A. As agents it is our responsibility to ensure that tenants applying for properties can in fact afford to pay the rent as a part of the referencing process.

I understand that different people handle their finances in very different ways, but you will have to meet and prove a basic affordability rate.

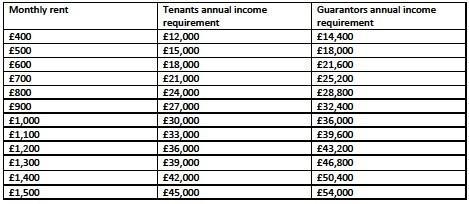

The industry standard used by agents and referencing agencies is x2.5 for a tenant and x3 for a guarantor. as demonstrated below This should always be calculated on the total rent not a proportional amount as tenants are jointly and severally liable for the full amount of rent.

The reasoning behind this is that you will need more than half of your income left to pay your bills and other living costs.

The guarantor's affordability requirement is slightly higher because it has to allow a margin for them to be paying their own mortgage or rent.

A guarantor may be taken if the income is slightly low but the agent has reason to believe that the tenant can afford it, or if the tenant’s income is not secured, for instance if they are still in a probationary period at work, on a zero hour contract, or are largely topped up by un-contracted over time or bonus.

An agent would be very irresponsible to put a tenant in to a tenancy that they simply could not afford, this would be a huge risk to the landlord’s rental income not to mention encouraging a tenant into large debt problems.

The criteria for qualifying for the different Local Housing Authority rates:

• One bedroom is allowed for each lone parent or couple

• One bedroom is allowed for each person over 16 years

• One additional bedroom is allowed for an over night carer

• Two children of the same sex under the age of 16 are expected to share a bedroom

• Two children under 10 are expected to share a bedroom regardless of gender

• Any other child one bedroom I would not advise a landlord to put in a housing benefit tenant at a rent too far above these levels.

Not because I want to penalise or demonise people claiming housing benefit as the media seems hell bent on doing at the moment, but for the same reason as I would not let a £1,000 a month property to someone on a £14,000 a year income.

Contrary to popular belief, living on benefits is a very tight budget.

Therefore topping up rent by a large monthly out of living allowance benefits such as Job Seekers Allowance would not be sustainable.

lInformation on Local Housing Allowance is provided by Stroud District Council and may vary in different areas.

Please continue to send your housing questions to us at rose@sawyersestateagents.co.uk.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereComments are closed on this article